The Buzz on Empower Rental Group

Wiki Article

Indicators on Empower Rental Group You Should Know

Table of ContentsThe Best Strategy To Use For Empower Rental GroupA Biased View of Empower Rental GroupSome Ideas on Empower Rental Group You Should KnowSome Known Incorrect Statements About Empower Rental Group Unknown Facts About Empower Rental Group

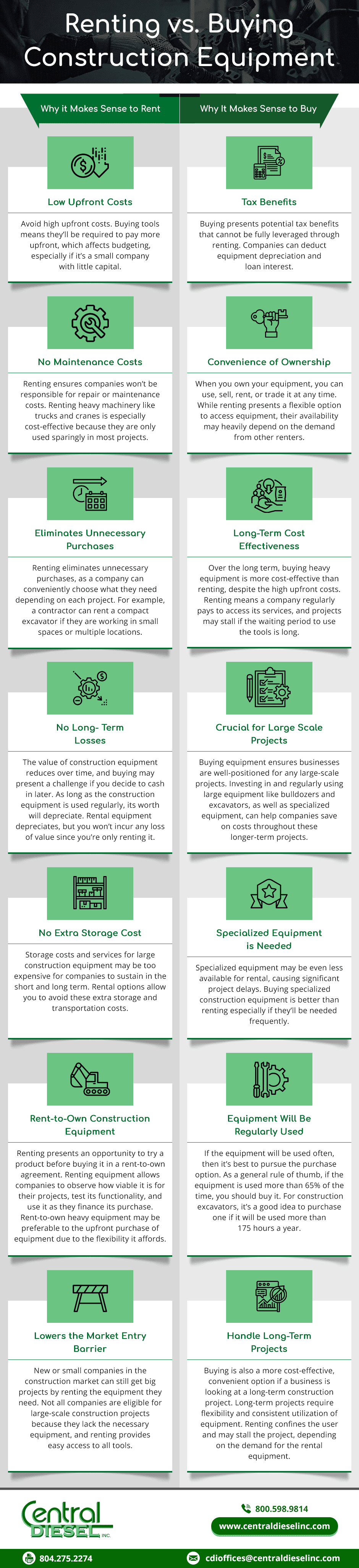

Consider the major aspects that will certainly help you choose to buy or rent your building equipment. https://empowerrental1.picturepush.com/album/3309547/p-Empower-Rental-Group.html. Your present monetary state The resources and skills readily available within your business for stock control and fleet monitoring The prices linked with purchasing and how they compare to leasing Your requirement to have devices that's available at a minute's notification If the had or leased equipment will be made use of for the appropriate size of time The biggest determining factor behind leasing or buying is how frequently and in what manner the hefty equipment is utilized

With the different uses for the multitude of construction devices items there will likely be a couple of makers where it's not as clear whether renting out is the very best alternative financially or acquiring will give you better returns over time - heavy equipment rental. By doing a few easy calculations, you can have a pretty excellent concept of whether it's best to rent out building tools or if you'll obtain the most gain from buying your tools

There are a variety of other factors to think about that will enter play, yet if your organization utilizes a specific item of equipment most days and for the long-lasting, after that it's most likely easy to establish that an acquisition is your finest method to go. While the nature of future tasks might change you can determine a finest assumption on your application price from recent usage and projected tasks.

What Does Empower Rental Group Do?

We'll chat about a telehandler for this example: Look at using the telehandler for the previous 3 months and get the variety of complete days the telehandler has actually been used (if it simply wound up obtaining used component of a day, after that add the components as much as make the matching of a full day) for our instance we'll say it was used 45 days (https://www.empowher.com/users/empowerrental1). mini excavator rentalThe application price is 68% (45 split by 66 equals 0.6818 increased by 100 to get a percent of 68). There's absolutely nothing incorrect with projecting use in the future to have an ideal rate your future utilization rate, especially if you have some proposal leads that you have a great chance of getting or have actually predicted jobs.

All about Empower Rental Group

If your application rate is 60% or over, buying is generally the most effective selection. If your application price is between 40% and 60%, then you'll want to think about just how the other variables relate to your organization and look at all the benefits and drawbacks of possessing and leasing. If your application price is listed below 40%, renting out is generally the finest option.

You'll always have the devices at your disposal which will be ideal for current tasks and also allow you to with confidence bid on projects without the worry of protecting the equipment required for the task. You will certainly have the ability to make the most of the considerable tax obligation deductions from the first purchase and the annual prices associated with insurance coverage, depreciation, loan passion repayments, repair work and upkeep expenses and all the added tax paid on all these associated costs.

Our Empower Rental Group Ideas

If you are considering methods that can grow your company then concentrating on fleet management would certainly be a rational means to go. Since it includes a different collection of service skills to handle a fleet, like transportation, storage space, solution and upkeep, and other facets of supply control, you could adhere to the pattern of creating a separate department or a separate corporation simply for your tools monitoring.

The obvious is having the suitable capital to buy and this is most likely the top issue of every company owner. Also if there is capital or credit scores available to make a significant acquisition, no one intends to be buying devices that is underutilized. Unpredictability tends to be the standard in the building and construction sector and it's challenging to truly make an educated choice concerning feasible projects two to five years in the future, which is what you require to consider when buying that ought to still be profiting your bottom line five years later on.

See This Report about Empower Rental Group

While there are a variety of tax obligation deductions from the purchase of new tools, rental expenses are additionally an accounting deduction which can typically be handed down directly to the customer or as a general overhead. They supply a clear number to aid approximate the exact cost of equipment usage for a task.

You can not be specific what the market will certainly be like when you're eager to market. There is required concern that you will not obtain what you would have anticipated when you factored in the resale worth to your acquisition decision five or one decade earlier. Even if you have a little fleet of equipment, it still requires to be appropriately procured the most set you back savings and keep the equipment well maintained.

Report this wiki page